If you’re considering a move this year, understanding the likely trajectories of home prices and mortgage rates is crucial. These two factors are central to decision-making in the housing market. This guide breaks down the current expert predictions on both fronts and helps you determine whether now is the right time to buy or if waiting might be more advantageous.

Home Prices Forecast

Current Predictions on Home Prices

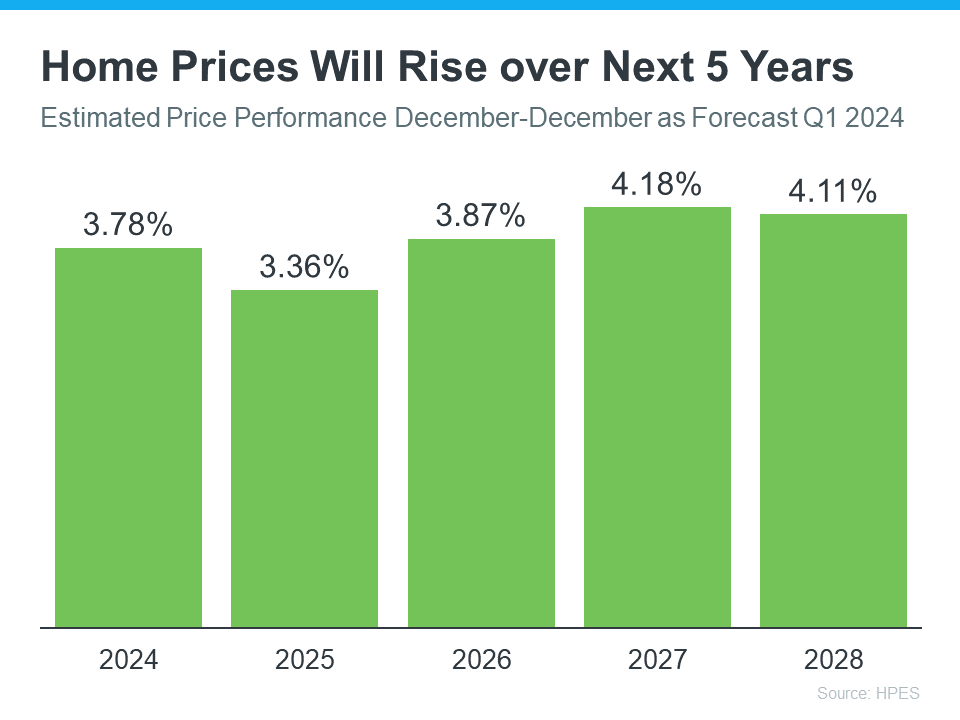

For those looking for reliable forecasts on home prices, the Home Price Expectations Survey by Fannie Mae is an excellent resource. This survey gathers insights from over one hundred economists, real estate experts, and investment and market strategists. The latest results project that home prices will continue to rise through at least 2028. While the rate of appreciation may vary annually, the overall trend is upward at a normalized pace (see the graph below).

Implications for Home Buyers

What does this mean for potential home buyers? Purchasing a home now could be financially beneficial as your property is likely to appreciate in value, helping you build equity over the coming years. Conversely, waiting could mean facing higher home prices as the market continues to climb, potentially making it more costly to enter the market later.

Mortgage Rates Outlook

The Future of Mortgage Rates

The future of mortgage rates remains uncertain and highly dependent on various economic factors. According to Odeta Kushi, Deputy Chief Economist at First American, factors like inflation, economic slowdowns, and geopolitical uncertainties can all influence mortgage rates. On one hand, a decrease in inflation or a slowing economy could lead to lower mortgage rates. On the other, any sign of rising inflation might push rates higher.

Experts remain hopeful that mortgage rates will decrease later this year, although this is subject to change based on new economic data and global events. As noted in a recent CNET article, mortgage rates are particularly sensitive to economic shifts and geopolitical developments.

Making the Right Decision For Your Home

For those ready and financially able to purchase a home, it might be wise to act sooner rather than later. Consulting with a trusted real estate advisor can help you weigh your options based on the latest market conditions and personal circumstances.

Bottom Line

Staying informed about the latest developments in home prices and mortgage rate predictions is crucial. Let’s connect and discuss the current market insights to help you make a well-informed decision regarding your potential move.

Call to Action: Partner with Sell for 1 Percent Realtors

At Sell for 1 Percent Realtors, we utilize modern technology to offer full-service brokerage at just 1% commission, significantly lowering the cost for our clients. If you’re considering selling your home, or want to buy and are looking for expert guidance that keeps more money in your pocket, partner with us. Let’s connect and explore how you can benefit from our innovative approach in today’s dynamic real estate market.