The post Maintaining Stable Mortgage Rates: The Key to a Soft Landing appeared first on sellfor1percent.

]]>This duality was at the forefront of the recent discussions surrounding Jerome Powell’s statements regarding interest rates and the Federal Reserve’s monetary policy. As the Chair of the Federal Reserve, Powell’s words carry significant weight, and his stance on interest rates has far-reaching implications for the housing market and mortgage industry.

The Importance of Stability in Mortgage Rates

During the recent market update, Jaysen Barlow, a real estate professional with Sell for 1%, expressed gratitude towards Powell’s decision to refrain from lowering interest rates too quickly. Barlow’s sentiment echoes a larger concern shared by many industry experts – the fear of triggering another market frenzy akin to the one witnessed during the COVID-19 pandemic.

Cast your mind back to 2020 when interest rates plummeted from 4% to 2%, fueling a buying frenzy that caused home prices to skyrocket by as much as $100,000 in some markets. Such drastic swings in pricing not only make it difficult for buyers to keep up but also create an unsustainable bubble that eventually bursts, leaving both buyers and sellers in a precarious position.

By maintaining a steady course and avoiding drastic rate cuts, Powell and the Federal Reserve are attempting to engineer a “soft landing” – a scenario where the housing market gradually cools without plunging into a full-blown recession. This approach aims to strike a delicate balance, preventing a chaotic market collapse while also discouraging the kind of unchecked price appreciation that can price many potential buyers out of the market.

The State of Mortgage Rates

According to Ryan Cochrane of NFC Lending, a mortgage expert featured in the market update, interest rates have remained relatively stable over the past few weeks. Depending on factors such as credit profile, loan amount, and overall financial strength, Cochrane notes that buyers can expect to see mortgage rates ranging from the mid-6% to mid-7% range.

While these rates may seem high compared to the historically low levels seen in recent years, they represent a degree of normalization that many economists and industry professionals have been advocating for. By maintaining rates within a reasonable range, the market can gradually adjust to a new equilibrium, allowing both buyers and sellers to make more informed and sustainable decisions.

Opportunities in a Stable Market

Despite the perception that higher interest rates may dampen buyer demand, the current market conditions present unique opportunities for both buyers and sellers. As Jaysen Barlow mentioned, he recently experienced a surge in bidding wars for some of his listings, indicating that there is still healthy competition among buyers.

For prospective homebuyers, acting sooner rather than later could be advantageous. With spring traditionally being a busy season for real estate, buyers who secure financing and make their moves now may be able to avoid even steeper competition and potential price hikes as the year progresses.

Sellers, on the other hand, can take advantage of the current market dynamics by pricing their properties competitively and leveraging the existing buyer demand. While the days of rapid price appreciation may be behind us, a stable market allows sellers to showcase their properties to a pool of qualified and motivated buyers, increasing the likelihood of securing a fair and reasonable sale price.

The Takeaway

As we navigate the complexities of the housing market and the ever-changing landscape of interest rates and monetary policy, it’s crucial to remember that stability should not be mistaken for stagnation. Instead, it presents an opportunity for both buyers and sellers to make informed decisions and participate in a market that is gradually finding its equilibrium.

By maintaining a steady course and avoiding drastic rate cuts or increases, the Federal Reserve and policymakers like Jerome Powell are attempting to create an environment where the housing market can cool in a controlled manner, reducing the risk of a sudden collapse or an unsustainable surge in prices.

If you’re considering buying or selling a home in the current market, it’s essential to work with experienced professionals who can guide you through the process and provide valuable insights based on the latest market trends. At Sell for One Percent, our team of dedicated real estate experts is committed to helping you make informed decisions and achieve your goals in a stable and sustainable manner. Contact us today to schedule a consultation and take the first step towards a successful real estate transaction.

Check out our YouTube page for more!

The post Maintaining Stable Mortgage Rates: The Key to a Soft Landing appeared first on sellfor1percent.

]]>The post Demystifying Interest Rates: Your Ultimate Guide appeared first on sellfor1percent.

]]>The Ever-Changing World of Interest Rates

Much like chameleons, interest rates exhibit rapid transformations, changing 2 to 3 times daily, leaving many puzzled about their underlying drivers. To decode this mystery, it’s crucial to recognize that interest rates represent the cost of borrowing and the reward for saving. High-interest rates mean greater expenses for borrowers and larger earnings for savers. They permeate personal finance, impacting mortgages, credit cards, savings accounts, and retirement funds. Thus, comprehending the intricate role of interest rates is essential for navigating the ever-evolving financial landscape effectively.

What Are Interest Rates?

Interest rates are financial linchpins that govern the cost of borrowing and the potential for earnings. When borrowing, higher interest rates mean more significant expenses over time, impacting monthly payments and the total loan cost. Conversely, for savers, higher rates equate to more substantial earnings, fostering compound growth and helping achieve financial goals. These rates profoundly influence personal finance, affecting mortgages, credit cards, savings accounts, and retirement funds, making them a fundamental factor in every financial journey.

Why Do Interest Rates Change?

Interest rates, often under the scope of the influence of central banks like the Federal Reserve, are versatile economic tools. Lowering rates stimulates borrowing, investment, and spending, fostering growth during economic downturns, while raising rates cools an overheating economy by discouraging excessive borrowing and spending, promoting saving, and maintaining price stability. Central banks consider diverse factors, including unemployment, consumer behavior, and global conditions when adjusting rates. These rate changes are not mere numbers but integral components of central banks’ strategies for guiding the economy through its cycles and ensuring financial stability.

Meet the Experts

Before we delve deeper into the world of interest rates, let’s introduce you to our panel of experts who will help break down the complexities. Our lineup includes:

- Broker: Dave Barlow

- Agent: Jaysen Barlow

- Agent: Jaime Barlow

- Loan Originator: Ryan Cochran from NFM Lending

These seasoned professionals bring a wealth of experience to the table, ensuring that you get the most accurate and insightful information.

The Caffeine Connection

But before we dive headfirst into the intricacies of interest rates, let’s talk about something that keeps our experts buzzing – caffeine. Just like the rest of us, they enjoy their coffee. It’s a lighthearted way to kick off a discussion that can be quite daunting.

As Roker humorously puts it, “I need an excuse to be able to show the NFL I’m lending.” It’s a reminder that even financial experts need their daily caffeine fix!

Understanding Interest Rate Fluctuations

Delving into the core of interest rate fluctuations, our expert Dave Barlow highlights a recent uptick, with a 6.95% average for 30-year loans as of the latest data. However, it’s essential to maintain perspective and avoid undue panic, as the rate you secure hinges on your financial profile, with stronger standings translating to better rates. This increase follows a period of decline spurred by the Federal Reserve’s mid-December rate cut. It’s vital to recognize that interest rates are part of a broader economic landscape influenced by factors beyond our immediate control, and despite recent shifts, overall conditions remain relatively favorable.

Putting It in Perspective

Adding context to the current interest rate scenario, Dave emphasizes that a mere couple of months ago, rates stood nearly a whole percentage point higher than their current levels. This historical perspective is crucial in understanding the significance of the recent increase. Even with this uptick, the broader perspective reveals that the environment remains largely favorable for borrowers. The recent change in rates, while noteworthy, should not overshadow the fact that borrowers today are still benefiting from historically reasonable lending conditions. These rates, although subject to fluctuations, continue to be attractive compared to the relatively higher rates experienced just a short while ago, offering borrowers favorable opportunities in the lending market.

Predicting the Future

Now, let’s shift our focus to the crystal ball and try to predict the future of interest rates. When will the Federal Reserve make its next move? According to Dave, the projections indicate a 4% chance of a rate cut at the next meeting. However, as the year unfolds, the chances of a cut increase significantly.

Dave explains that the market has already priced in these projections. Therefore, if the Federal Reserve follows this trajectory, it shouldn’t come as a surprise to anyone. The consensus seems to be that rates will start dropping as we approach the election, with mid-September being a key period for a potential two-point reduction.

Wrapping Up

As our conversation comes to a close, it’s clear that the experts don’t take themselves too seriously. They reflect on the recent “two-minute drill” they attempted and joke about how it seemed like they were trying to start a clock.

In the end, it’s all in good fun, and they leave us with a light-hearted farewell, reminding us that finance is not all numbers and statistics. It’s important to have a sense of humor and not get too caught up in the complexities of interest rates.

So, what have we learned from this insightful and entertaining discussion? Interest rates are in a state of flux, but they’re still favorable compared to recent history. The future holds potential rate cuts, and as long as you keep an eye on the projections, you can make informed financial decisions.

Stay tuned for more financial insights from our panel of experts in the coming weeks!

The post Demystifying Interest Rates: Your Ultimate Guide appeared first on sellfor1percent.

]]>The post The Impact of Lower Mortgage Rates on the Housing Market appeared first on sellfor1percent.

]]>The Mortgage Rate Lock-In Effect on the Housing Market

Over the past year, one critical factor that has limited options for potential homebuyers is the shortage of available homes. This scarcity has arisen because many homeowners decided to postpone selling their properties when mortgage rates began to rise. An article from Freddie Mac provides insight into this phenomenon:

“The lack of housing supply was partly driven by the rate lock-in effect. . . . With higher rates, the incentive for existing homeowners to list their property and move to a new house has greatly diminished, leaving them rate locked.”

In simpler terms, these homeowners chose to stay in their current homes and maintain their lower mortgage rates rather than relocating and accepting a higher rate on their next home.

Early Signs of Housing Market Change

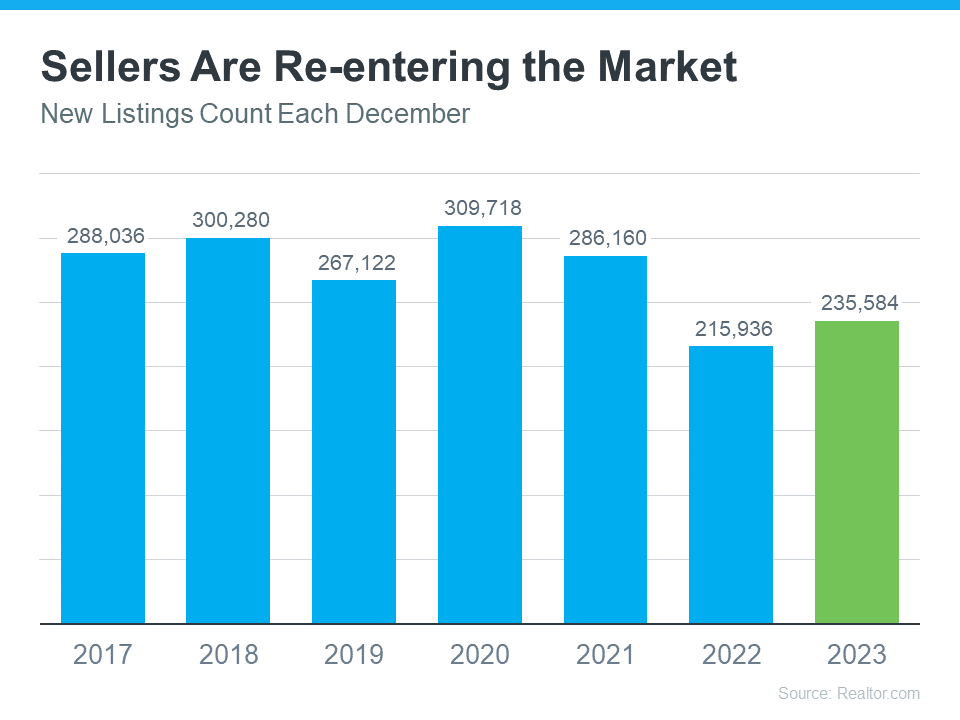

Recent data from Realtor.com reveals a noteworthy shift. In December 2023, there were more homeowners listing their properties for sale, which is commonly referred to as “new listings,” compared to December 2022. This is a significant development because traditionally, the housing market tends to cool down in the later months of the year, as some sellers delay their moves until the new year.

This uptick in new listings during December 2023 is the first of its kind since 2020. It could be an early signal that the rate lock-in effect is easing in response to lower mortgage rates.

Implications for Homebuyers

While it’s unlikely that there will be a sudden surge in available homes, the increase in new listings suggests that more sellers may be considering listing their properties. According to a recent article from the Joint Center for Housing Studies (JCHS):

“A reduction in interest rates could alleviate the lock-in effect and help lift homeowner mobility. Indeed, interest rates have recently declined, falling by a full percentage point from October to November 2023 . . . Further decreases would reduce the barrier to moving and give homeowners looking to sell a newfound sense of urgency . . .”

In practical terms, this means you may start to see more homes entering the market, providing you with a broader range of fresh options to consider.

Bottom Line

As mortgage rates continue to decrease, it’s possible that more sellers will re-enter the market. This presents an opportunity for homebuyers to find the home they’ve been searching for. If you want to stay updated on the latest listings in your area, consider connecting with us, we would love to assist you in your home search journey.

The post The Impact of Lower Mortgage Rates on the Housing Market appeared first on sellfor1percent.

]]>The post BTFP, MBS and their Impact on Interest Rates appeared first on sellfor1percent.

]]>The Bank Term Funding Program (BTFP) is a program that provides funding to banks to maintain their lending activities. The program was introduced by the Bank of England in 2016 to encourage lending to households and businesses. The program provides funding to banks for a period of four years at low interest rates. The aim of the program is to ensure that banks continue to provide credit to the economy during times of financial stress.

The Impact of the Bank Term Funding Program on High Interest Rates

The Impact of the Bank Term Funding Program on High Interest Rates

The Bank Term Funding Program was designed to provide funding to banks at a low-interest rate. This was intended to encourage banks to lend more money to businesses and households, which would increase spending and stimulate economic growth. However, if interest rates were to rise, it could make it more expensive for banks to borrow money from the Bank of England. This would reduce the incentive for banks to lend money, which could slow down economic growth.

The Federal Reserve Bank may choose to issue the Bank Term Funding Program (BTFF) amidst high interest rates to provide additional liquidity to banks and financial institutions. When interest rates are high, it can be difficult for banks to obtain funding from other sources such as the money market or through deposits. The BTFF allows banks to borrow directly from the Federal Reserve at a lower interest rate, providing them with a more stable source of funding. This can help to alleviate some of the pressures faced by banks during times of high interest rates and ensure that they are able to continue lending to businesses and consumers. Furthermore, the BTFF can also help to stabilize the financial system by providing banks with a safety net during times of economic uncertainty.

The Effect of Interest Rates on Mortgage Rates

Mortgage rates are influenced by interest rates. When interest rates are high, mortgage rates also increase, making it more expensive for households to buy homes. This can lead to a decrease in demand for housing, which can slow down the economy. On the other hand, when interest rates are low, mortgage rates also decrease, making it more affordable for households to buy homes. This can lead to an increase in demand for housing, which can stimulate economic growth.

Mortgage-Backed Security Bonds

Mortgage-backed security bonds are a type of bond that is backed by a pool of mortgages. These mortgages are usually issued by banks and other financial institutions. The mortgages are bundled together and sold to investors in the form of bonds. The investors then receive regular payments from the mortgage pool’s cash flows.

Mortgage-backed security bonds are classified as fixed-income securities, meaning that they offer a fixed rate of return. These bonds are usually issued with a maturity date, after which the investors receive their principal back. The interest rate on the bond is usually higher than the current market interest rate, making it an attractive investment option for those looking for steady cash flows.

How Mortgage-Backed Security Bonds Affect Mortgage Rates

Mortgage-backed security bonds have a direct impact on mortgage rates. When investors purchase these securities, they provide financial institutions with the funds needed to issue new mortgages. This means that the interest rate on these new mortgages is directly tied to the interest rate on the mortgage-backed security bonds. When the interest rate on these bonds increases, the interest rate on new mortgages also increases. This can make it more difficult for potential buyers to afford a new home.

Investors may choose to buy mortgage-backed security bonds for a variety of reasons. Firstly, these bonds provide a relatively stable source of income, as the cash flows generated from the underlying mortgages are used to pay the bondholders. Additionally, the interest rates on these bonds are typically higher than those of other fixed-income securities, making them an attractive investment option for those seeking higher yields. When a lot of mortgage-backed security bonds are bought, the demand for these bonds increases, which can lead to a decrease in mortgage rates. This is because when more investors are willing to buy these bonds, lenders can issue more mortgages and still sell them to investors, even if they reduce the interest rate. Thus, the purchase of mortgage-backed security bonds can lead to a decrease in mortgage rates, making it easier for potential homebuyers to enter the market.

Varying Mortgage Rates

Mortgage rates can vary significantly from one individual to another, as they are based on a variety of factors specific to each borrower. One of the most important factors is the borrower’s credit score, as lenders use this score to assess the borrower’s creditworthiness and determine the risk of default. A higher credit score typically results in a lower interest rate, while a lower credit score may result in a higher interest rate or even a rejection of the loan application altogether. Another important factor is the borrower’s debt-to-income ratio, which compares the borrower’s monthly debt payments to their monthly income. A lower debt-to-income ratio typically results in a lower interest rate, as it indicates that the borrower is less likely to default on the loan. Finally, the amount of a downpayment can also affect the interest rate, as a larger downpayment may result in a lower interest rate or lower monthly payments. Overall, mortgage rates are personalized based on the borrower’s financial situation and creditworthiness.

What Does it All Mean?

Mortgage rates are influenced by several factors, including the state of the economy and the policies of central banks. If the Bank Term Funding Program is implemented, it could lead to a drop in mortgage rates. This program allows banks to borrow funds at a lower interest rate, which they can then lend out to consumers. This could lead to increased competition among lenders, resulting in lower rates for borrowers. Moreover, if people start buying mortgage-backed security bonds, it could also lead to lower mortgage rates. When investors buy these bonds, it provides more funds for lenders to lend out to consumers, resulting in lower rates. Overall, both of these scenarios could lead to more favorable mortgage rates for borrowers.

Lower Mortgage and Interest Rates are Good for the Market

Lower Mortgage and Interest Rates are Good for the Market

Lower mortgage rates can have a significant impact on both buyers and sellers in the real estate market. For buyers, lower mortgage rates can increase affordability and purchasing power, allowing them to buy a more expensive home or make lower monthly payments. This could lead to increased demand for homes and potentially drive up prices. For sellers, lower mortgage rates could increase the pool of potential buyers, leading to increased competition and potentially driving up prices. Additionally, lower mortgage rates can make it easier for sellers to attract buyers who may have been hesitant to enter the market due to higher interest rates. Overall, lower mortgage rates can benefit both buyers and sellers in the real estate market, increasing affordability for buyers and potentially driving up prices for sellers.

Overall Things are Looking Up for Interest Rates

As we look ahead to the future of real estate, there are several reasons to be optimistic. Firstly, the implementation of the Bank Term Funding Program and increased buying of mortgage-backed security bonds could lead to lower mortgage rates, making it easier for potential buyers to enter the market. This could result in increased demand for homes and potentially drive up prices, benefiting sellers as well. Additionally, the spring market is right around the corner, which typically sees an uptick in activity and inventory. With these factors at play, now may be an opportune time for both buyers and sellers to enter the market. As we move forward, it’s important to keep an eye on these trends and take advantage of the opportunities they present in the real estate market.

For more discussion on this topic check out our new interest rates as of 3/16/23 video:

Looking to sell your home and save thousands in commissions? Maybe you’re looking for a trusted realtor to buy your next home with. Look no further than Sell for 1 Percent Realtors! Our experienced and knowledgeable team stays on top of current trends in the real estate market, and we’re always ready to talk when you are. Trust us to help you navigate the home selling process and put more money back in your pocket. Call us today to learn more!

The post BTFP, MBS and their Impact on Interest Rates appeared first on sellfor1percent.

]]>The post Interest Rates as of 3/10/23 appeared first on sellfor1percent.

]]>The interest rates for 30-year fixed loans have remained high, with non-farm payroll and CPI numbers being determining factors for rates moving forward. The conventional loan structure is undergoing changes, with pricing now also factoring in debt-to-income ratio and credit score. The best rate currently is 6.875%, while mid-sevens to 7.6% could be expected for credit scores in the 600-680 range. FHA loans will see a decrease in monthly mortgage insurance from 0.85 to 0.55 starting March 20th, resulting in lower payments. FHA loans do not have loan level price adjustments, unlike conventional loans.

Transcription:

Dave: (00:05)

Hey there everyone. Dave Barlow here with the Sell for 1% Gang. We got Scott Hall . Yeah, there he is. , we got Jaimerinsky, Mike Hopper, and our very special guest to keep us all in line this morning. Rich Ch-con-y, . Am I getting it down?

Rich: (00:27)

You’re getting better at it Dave. We’re going to nominate you into the Italian American Club pretty soon.

Dave: (00:35)

I’m going to get yelled at later on. I know. First by my daughter, then by my wife. You got it all wrong, . I do it. Especially for them.

Speaker 3: (00:44)

Yeah.

Dave: (00:46)

So Rich, interest rates are a little like the weather one day. It’s nice. Next day, not so much. What’s going on out there in the world of interest rates?

Rich: (00:58)

Well, right now it’s the January of interest rates cause it’s pretty much not so nice. We’ve had a really bad month for the month of February in terms of progression towards higher rates. The economic numbers, as we’ve talked about many times have, not been conducive to lower rates the entire month. And we’re still at that high six, low seven kind of a rate right now on a 30 year fix. And the numbers tomorrow and next week are really, really big. So stay tuned and we’ll see how things go. But we have a non-farm payroll number tomorrow morning, which is what the Fed is really looking at. We’re looking at job creation, how many jobs are created or not created in the economy. So depending on what happens with that number tomorrow morning at 8:30, and then next week the CPI number comes out. So we’ll have a CPI consumer price index number on Tuesday. Those two figures will be a determining factor as to what, we’re seeing in terms of rates moving forward I think for the next 30 days or so.

Dave: (02:22)

And so the one thing, cause everything’s kind of like the opposite of what you would think, we got somewhat good news this morning, although I would say it’s not so good news, but jobless claims were higher than expected

Rich: (02:38)

Right.

Dave: (02:39)

For interest rates. That’s good news.

Rich: (02:42)

Yeah, bad news is good news. Yeah, bad kinda like, it’s one of the conundrums of my, profession. But, that is correct that we had more jobless claims than what were expected. And consequently, we’re seeing the stock market rally a little bit and we’re seeing interest rates at least not go up today. I wouldn’t say their interest rates have gone down today, but they, they quit going up, at least for the time being. So, that’s kind of where we are. And so, bad news tomorrow, meaning that there, there weren’t so many jobs created would be good news for interest rates because the bad news means that the Fed doesn’t have to continue to fight a strong economy with higher rates. So that’s why bad news is good news for interest rates, basically.

Dave: (03:36)

And so right now we are kind of straddling that 7% number right now.

Rich: (03:43)

Correct. And you know, one of the things I want to mention, Dave, because this is happening live right now as we speak, is that there are many changes happening in the conventional loan structure. There’s something in the pricing of conventional loans. It’s called loan level price adjustments, L L P A. And there’s essentially a grid and it’s credit score and loan to value. And now they’ve added also debt to income into that. And those three factors, depending on what your credit score is, how much you’re putting down and what your debt to income is, all three of those factors determine adjustments to what the standard rate would be for you. So if a person calls me up and says, what’s your rate today? I have about five or six questions that have to be asked before I can even begin to quote them an exact rate. That’s just the reality of what’s happening with conventional loans right now.

Dave: (04:48)

So if I called up and said, Hey, rich, I’d like to get a loan. What, are those questions that I should be prepared for?

Rich: (04:57)

Well, I’m going to want to know what your credit score is. And a lot of times people have gotten a credit score from Credit Karma or something like that, you know, that that maybe is not the same credit scores that I would get if I ran your credit. So if you really want an exact number, I’m going to have to run your credit, do a hard pull on your credit and we’re going to need to know how much are you putting down? And then I’m going to have to do a calculation to determinewhere you fall on your debt to income structure. So once I’ve run your credit, I can see what your debt is, and then if I can get a clear picture of what your income is, then I can do that calculation and be able to give you an answer. Now that, I mean this, I hate to make things complicated as, you know, I try to make things simple. But, uh, that’s where we are in 2023 with the banking business and the way the federal government has become involved in everything that we do.

Dave: (05:53)

So if everything comes back aces, I’ve got excellent credit score. My debt to income is good. Everything else, you know, that you’re looking at, what’s the best rate that I can get in today’s world?

Rich: (06:09)

6.875% would be the, would be the rate right at this moment. So we’re right there, as I said, straddling that 7% rate. That’s where we would be.

Dave: (06:22)

And then if I, let me ask real quick, and then if I’m kind of suspect, and you can still get me done, what kind of rate would I expect?

Rich: (06:32)

Well, let’s say someone has, has a credit score in the, 600-680 range, they could be looking at mid sevens. It can go up that much. Wow. Mid, mid to mid sevens to 7.6, uh, on a situation like that.

Dave: (06:53)

Okay. So I mean, you’re half a point to five eighths of a point higher if your credit’s just not quite as strong.

Rich: (07:02)

That is correct. Yeah.

Dave: (07:04)

Huh. That’s a big difference. Cause a year ago it was pretty much, you know, run my credit and off we went.

Rich: (07:11)

Yeah. Well, we tried to simplify. Like I said, I’ve learned in 25, 30 years of business, you know, keep it simple, stupid. So, you know, I kind of like try to get a feel for someone, you know, in a conversation and give them a quote and try to stand by it as easily as I could. But the minutiae has gotten much more, prevalent now. So we, there’s all these things that we need to consider when we’re looking at someone’s interest rate. And again, I try to make assumptions and give people a rule of thumb at least so that they can decide if they want to make an offer and have some feel for where their payment would be without me having to run their credit. I don’t try to make it a difficult discussion.

Dave: (07:56)

Sure, sure.

Rich: (07:58)

So, Hey Dave, I do have, I do have some good news on one front. All right.

Dave: (08:04)

We’ll take it. You

Rich: (08:05)

You know, the loans we’ve been discussing here so far, conventional loans, but then there’s also FHA loans. So with FHA loans, um, there’s a change coming March the 20th, where the mortgage insurance, the monthly mortgage insurance is decreasing. So, it has been a fact a factor of 0.85. The mortgage insurance on an FHA loan has been 0.85 to whatever amount you’re financing divided by 12. FHA is lowering that to 0.55. So 30 basis points lower on the mortgage insurance. So that’s substantial in terms of someone’s payment that’s over a quarter percent lower on their payment on an FHA loan. So that’s a little bit of good news at least.

Dave: (09:05)

And so for clarification, the LLPA does not apply to FHA loans?

Rich: (09:11)

Correct. FHA loans do not have loan level price adjustments. Those are conventional loans and nationwide conventional loans, Fannie Mae and Freddie Mac.

Dave: (09:21)

Yeah. And so it kind of seemed, you know, after the financial crisis and, Freddie Mack and Fannie Mae, you know, be almost became insolvent and the federal government stepped in and, and helped out their own entities, so to speak, uh, that they were really trying to push more people towards FHA financing., and I think I’ve read that as much as 60% of all home loans now are FHA

Rich: (09:52)

You know, if you’ve read that, I’ll go with your figure. I don’t, have that off the top of my head. I wouldn’t say that my business is 60% FHA though. Um, you know, I am still doing a healthy amount of conventional still, and still all things being equal. Conventional mortgage is a little bit of a better, and if someone has good credit, the the better way to go would be a conventional loan because of some of the long-term, uh, mortgage insurance and upfront mortgage insurance cost of the FHA.

Dave: (10:25)

Okay. All right. Well, I appreciate your time. Thanks for the information. And of course, if anybody has a question, your contact information is here on the screen, feel free to give Rich a call. He’s been doing this a long time, has a lot of information, a lot of knowledge, and, and, uh, more importantly, a lot of experience to get you from point A of wanting to look at houses to point B, which is actually closing on your new home. So again, Rich, thank you.

Rich: (10:54)

Thank you, Dave. Appreciate it.

Dave: (10:56)

All right guys. Thanks for joining us here this morning.

Rich: (10:59)

Have a good one.

The post Interest Rates as of 3/10/23 appeared first on sellfor1percent.

]]>The post Interest Rates as of 12-21-22 appeared first on sellfor1percent.

]]>Dave (00:03):Hey there everyone. Dave Barlow here with Sell For One Percent. We got the whole gang here today.

Everybody’s healthy, feeling better and looking sharp for the Christmas holidays. Let’s jump right into

interest rates. SB, what do you have for us?

Steve (00:22):

Well, happy holidays everybody. We’ve got some good news! Recently, the Fed here in the month of

December raised the interest rate for another half percent. When the Fed raises the rate like that, it

really doesn’t affect our mortgage rates except with the ARM products. With that being said, for the

seventh consecutive month that the Fed has raised the rate, this week our interest rates have held

steady, which is good news. Maybe a little more money in your pocket to get out there and do some

holiday shopping.

The 30 year fixed rate continues to be at 6.125%, the 15 year rate is 5.625%, and the

FHA rate this morning was at 6.25%.

Our interest rates are holding steady and according to

research, a lot of the economists, and a lot of the predictors, after we get into 2023, look for those rates

to drop back into the 5% area. So it’s good news if you’re getting ready to get into the real estate

market.

Dave (01:36):

Good news for home buyers for sure. We talked to Rich Cercone over at Equitable Finance last week, and

Rich said that a lot of the mortgage rates are predicated on what the economy is doing. The consumer

price index, looking at inflation rates and so on and so forth. So they already knew the half point raise

was going to come from the Fed that was already built into expectations. So when the CPI came out a

little lower than expected, it pulled those interest rates down some. So again, good news for home

buyers. The other part is that the inventory levels have continued to be around 3000, and we’ll talk

about that a little bit more. There are also more homes on the market which results in interest rates going

down. I can tell you that my sellers are open to helping with closing costs. So, we haven’t seen that in

about two and a half, three years that a seller is actually saying, “Hey, I can help with closing costs”

versus “Let’s list it for this and expect $40,000 higher than our list price.” A lot of good news out there in

the market for home buyers. All right, guys. Thanks.

The post Interest Rates as of 12-21-22 appeared first on sellfor1percent.

]]>The post Clearing Up the Confusion: A Guide to Comparing FHA vs Conventional Loans appeared first on sellfor1percent.

]]>

Introduction to FHA and Conventional Loans

FHA vs Conventional loans, the first thing to understand is the basics of each type of loan. FHA loans are backed by the Federal Housing Administration, while Conventional loans are not. FHA loans are considered government-backed loans, while Conventional loans are from entities outside of the governmental scope.

FHA loans are typically offered to those with lower credit scores, or those who may not have the funds for a large down payment. They are typically easier to qualify for than Conventional loans, but they also come with certain restrictions.

Conventional loans, on the other hand, are not backed by any government agency. They usually require a larger down payment, and they typically have stricter credit score requirements. Conventional loans are typically offered to those with higher credit scores, or those who have the funds for a larger down payment.

FHA Loan Advantages

When comparing FHA vs Conventional loans, it’s important to note that FHA loans come with a few key advantages. One of the biggest advantages of FHA loans is that they are easier to qualify for. Since FHA loans are backed by the government, they typically have less stringent credit score requirements than Conventional loans. Borrowers with lower credit scores usually find that FHA loans cost less per month than a conventional loan

Another advantage of FHA loans is that they typically have lower down payments than Conventional loans. This can make them more accessible to those who might not have the funds for a large down payment. FHA loans also come with certain benefits, such as the ability to roll closing costs into the loan, and the ability to refinance at a lower interest rate.

Conventional Loan Advantages

Conventional loans come with a few key advantages as well. One of the biggest advantages of Conventional loans is that they typically offer lower interest rates than FHA loans. This can save you money over the life of the loan, which can make them a great option for those looking to save money.

Another advantage of Conventional loans is that they often have fewer restrictions than FHA loans. This can make them a great option for those who are looking for more flexibility in their mortgage. Conventional loans also typically have fewer fees associated with them, which can also save you money.

Finally, Conventional loans often have higher loan limits than FHA loans. This can be beneficial for those looking to buy a larger home, or those who are looking for more financing options.

Comparing Loan Rates

With FHA vs Conventional loan rates, it’s important to keep in mind that FHA loans typically have lower interest rates than Conventional loans. This is because FHA loans are backed by the government, and the government often offers lower interest rates than the market.

However, it’s important to note that FHA loans also come with certain restrictions and fees that can add to the cost of the loan. It’s important to compare the total cost of the loan, including the interest rate, fees, and other costs (amortization), to make sure you’re getting the best deal.

Comparing Loan Requirements

When looking at FHA vs Conventional loan requirements, you will find that FHA loans typically have less stringent credit requirements than Conventional loans. FHA loans often require a lower credit score, and they may also allow for higher debt-to-income ratios. The debt-to-income ratio must be 56.99% or less for an FHA loan while it is 45% or less for conventional loans.

It’s also good to know that FHA loans typically have lower down payment requirements than Conventional loans. FHA loans often require a down payment of at least 3.5%, while Conventional loans often require a down payment of at least 5%.

Comparing Loan funding fees

Comparing FHA vs Conventional loan funding fees, FHA loans typically come with a higher funding fee than Conventional loans. FHA loans often require a funding fee of 1.75%, while Conventional loans typically require a funding fee of 0.5%.

However, FHA loans also typically require a lower down payment than Conventional loans, which can offset the higher funding fee. Additionally, some FHA loans may be eligible for a funding fee waiver, which can make them even more affordable.

Comparing Loan Qualification

When going over both loan qualifications, typically FHA loans require a lower credit score than Conventional loans. FHA loans often require a credit score of 580 or higher, while Conventional loans typically require a credit score of 620 or higher.

Additionally, FHA loans often require a lower debt-to-income ratio than Conventional loans, 56.6% for FHA and 45% for conventional. This means that you may be able to qualify for an FHA loan with a higher debt-to-income ratio than you would for a Conventional loan.

Comparing Loan Limits

When comparing FHA vs Conventional loan limits, it’s important to note that FHA loans typically have lower loan limits than Conventional loans. FHA loans are typically capped at $331,760, while Conventional loans can go as high as $625,500 in some areas. FHA loan limit in Franklin County for 2023 will be $488,750 and conventional loan limit will be $726,200, loan amounts any higher become considered a “Jumbo” loan.

The loan limits for FHA loans can vary depending on the area, so it’s important to check with your lender to see what the loan limits for your area are.

Comparing Loan Credit Score Requirements

FHA loans typically require a lower credit score than Conventional loans. FHA loans often require a credit score of 580 or higher, while Conventional loans typically require a credit score of 620 or higher.

Additionally, FHA loans may be eligible for a credit score waiver, which can make them even more accessible to those with lower credit scores. Some lenders may be willing to work with you on an individual basis to determine if you are eligible for an FHA loan.

Comparing Loan Closing Costs

When comparing, FHA loans typically have lower closing costs than Conventional loans. FHA loans often have fees associated with them, including the upfront mortgage insurance premium and the annual mortgage insurance premium.

However, FHA loans also typically have lower down payment requirements than Conventional loans, which can offset the higher closing costs. Some FHA loans are eligible for closing cost assistance, which can make them even more affordable. FHA mortgage insurance is mandatory regardless of the down payment amount, it can’t be canceled unless you refinance into a conventional loan. For conventional loans a private mortgage insurance is required when the down payment is less than 20%, and it may be canceled after 20% equity has been hit.

Comparing Refinancing

Concerning refinancing, FHA loans can often be refinanced at a lower interest rate than Conventional loans. This can save you money over the life of the loan and can make a great option for those looking to save money.

However, again, FHA loans typically have higher closing costs than Conventional loans, so it’s important to compare the total cost of the loan to make sure you’re getting the best deal. Don’t forget that FHA loans are eligible for closing cost assistance, which can help offset the higher closing costs.

Conclusion

When it comes to mortgages, it can be difficult to determine which type of loan is the best for you. FHA and Conventional loans both have their advantages and disadvantages but understanding them can help you make an informed decision.

When comparing FHA vs Conventional loans, it’s important to consider the interest rate, fees, loan limits, credit score requirements, and other factors. Additionally, it’s important to weigh the advantages and disadvantages of each type of loan to determine which one is the best for you.

If neither of these sound like good options, give us a call today, with 50+ years of experience and our list of people we trust in the business we will help you find your perfect loan!

The post Clearing Up the Confusion: A Guide to Comparing FHA vs Conventional Loans appeared first on sellfor1percent.

]]>The post Interest Rate DROP- Dec 7, 2022 appeared first on sellfor1percent.

]]>

Dave: (00:03)

All right, Jaimerinski , whenever you’re ready. Give us a countdown. Three, two, Boom.

Steve: (00:11)

Beep.

Jaime: (00:13)

I don’t wanna do the intro.

Dave: (00:14)

You’re doing the intro.

Jaime: (00:17)

The *quack* do I say

Dave: (00:18)

Whatever you wanna say.

Jaime: (00:23)

Welcome back to another installation of three…

Steve: (00:27)

What, what are we installing?

Dave: (00:36)

We’re installing another episode…

Steve: (00:39)

We’re installing information.

Jaime: (00:44)

Welcome back to another information installation brought to you by Sell for 1 Percent realtors.

Dave: (00:52)

There you go.

Jaime: (00:55)

You do the intro.

Dave: (00:56)

All right, everyone. SB, I think Jaime did a about as good as he could there. So off you go. Tell us about interest rates

Steve: (01:06)

Hey guys. Welcome back to Sell for 1 Percent We’re certainly glad you’re here. And we want to wish our colleague Mike Hopper well. He is under the weather and not able to be with us this week, so take care of yourselves out there. It’s certainly going around.

Good news with interest rates. Last week we reported 6.375 on the 30 year fixed rate, rates have dropped down to 6.25. The 15 year rate from 5.875 last week to 5.625 this week. And the FHA rate from 6.375 last week down to 6.25 this week.

And we were talking a little bit here, before we got rolling; There’s an interesting thing that I think needs to be pointed out. It’s about the

Fed overnight rate

that has been raised 4 consecutive months in a row now, and interest rates. DB interest rates continue to fall even though the Fed keeps raising the overnight rate.

Dave: (02:17)

Well, I think a lot of people get confused because they see the Fed, they see the Fed, they see the Fed, and the Fed and mortgage rates are loosely tied together, but they’re not directly tied together. And so even though the Fed is raising rates, and, and we saw that back at the first of December when they raised rates three quarters of a point, and then the next day we saw interest rates and mortgage interest rates actually drop. And so over the last, you know, few days we’re seeing interest rates continue to drop and it’s a direct result of high interest rates. There’s just not enough demand for the supply of money that’s out there. And so interest rates are falling and we’ll see where they head long term. But the main thing to keep in mind here is that

the Fed overnight rate is not directly tied to mortgage interest rates.

And we should probably do a video about that.

Steve: (03:23)

Well, what a great time to get back into the market. You know, couple good things, there’s not a lot of buyers out there right now, and so

chances of you getting into a bidding war, right now, are pretty slim.

There are sellers out there that still need to sell houses and with interest rates dropping today may be a good day to get some more information by giving us a call right here at Sell for 1 Percent.

Dave: (03:49)

We had a lender on Friday, late Friday, send out a message that said

interest rates had dropped to 6%

and he just wanted us to know for the weekend. And I think you’re exactly right, SB, that interest rates are coming down. As a buyer, you may wanna look at some houses that have been on the market for 60, 70, 80, 90 days. Those sellers, obviously here during the Christmas period, have got to sell something or else they wouldn’t be on the market. And after, two, three months of not getting an offer,

you may have an opportunity to be able to buy something.

So as SB said, give us a call, we’d be happy to help.

Steve: (04:34)

(614) 451-6616, (614) 778-0826. Give us a call here at Sell for 1 Percent.

The post Interest Rate DROP- Dec 7, 2022 appeared first on sellfor1percent.

]]>