Over the past couple of years, many people have faced significant challenges in the housing market. While affordability remains tight, there are promising signs of improvement that could continue throughout the rest of the year. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), provides an optimistic perspective:

“Housing affordability is improving ever so modestly, but it is moving in the right direction.”

In this article, we’ll explore the latest data on the three biggest factors affecting home affordability: mortgage rates, home prices, and wages.

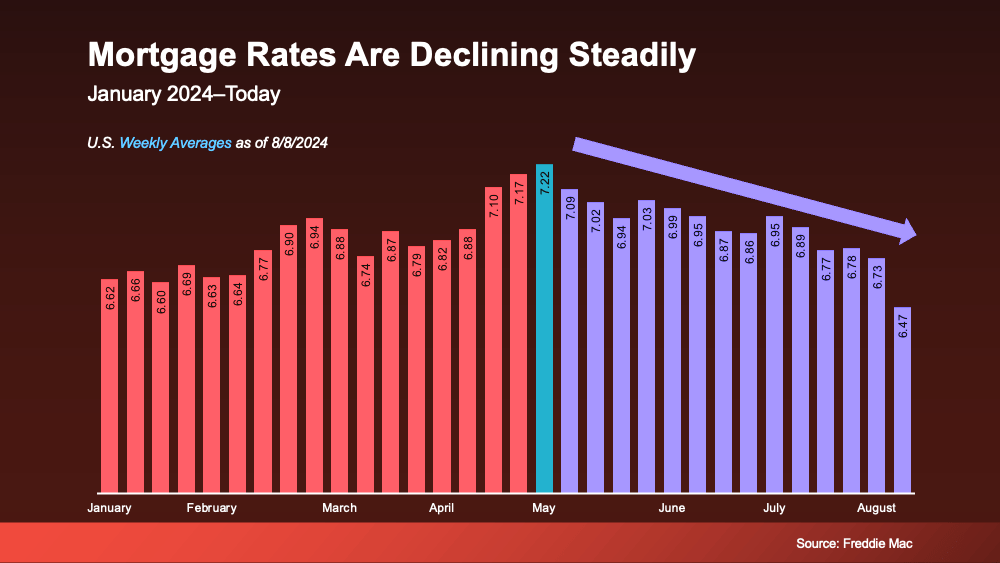

Mortgage Rates for Housing

Mortgage rates have experienced significant volatility this year, fluctuating between the mid-6% and low-7% range. However, there’s encouraging news. Data from Freddie Mac indicates that rates have been trending down overall since May.

The recent improvement in mortgage rates can be attributed to positive economic, employment, and inflation data. While some rate volatility is expected going forward, experts believe that if future economic data continues to show signs of cooling, mortgage rates could continue to decrease.

Even a small decline in mortgage rates can have a substantial impact. Lower rates make it easier to afford the home you want because your monthly payments will be lower. However, it’s important to manage expectations; rates are unlikely to return to the historically low 3% range.

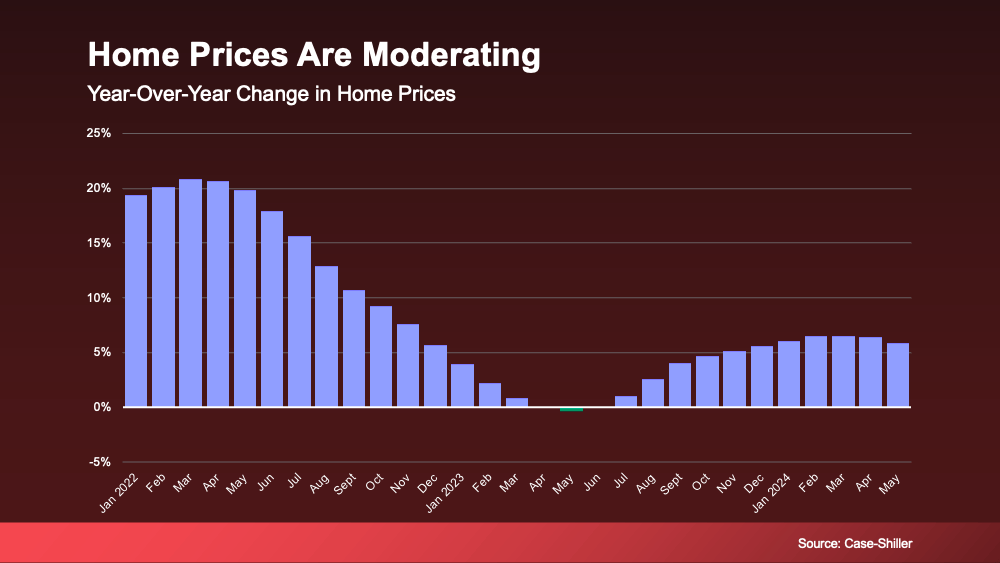

Housing Prices

Another critical factor to consider is home prices. While national home prices are still increasing this year, the rate of growth has slowed compared to a couple of years ago. The graph below, using data from Case-Shiller, illustrates this trend:

For prospective homebuyers, slower price growth is positive news. The rapid increase in home prices during the pandemic made it difficult for many people to purchase homes. Now, with prices rising more slowly, the prospect of buying a home may feel more attainable. Odeta Kushi, Deputy Chief Economist at First American, highlights this point:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help – so the dream of homeownership isn’t boarded up just yet.”

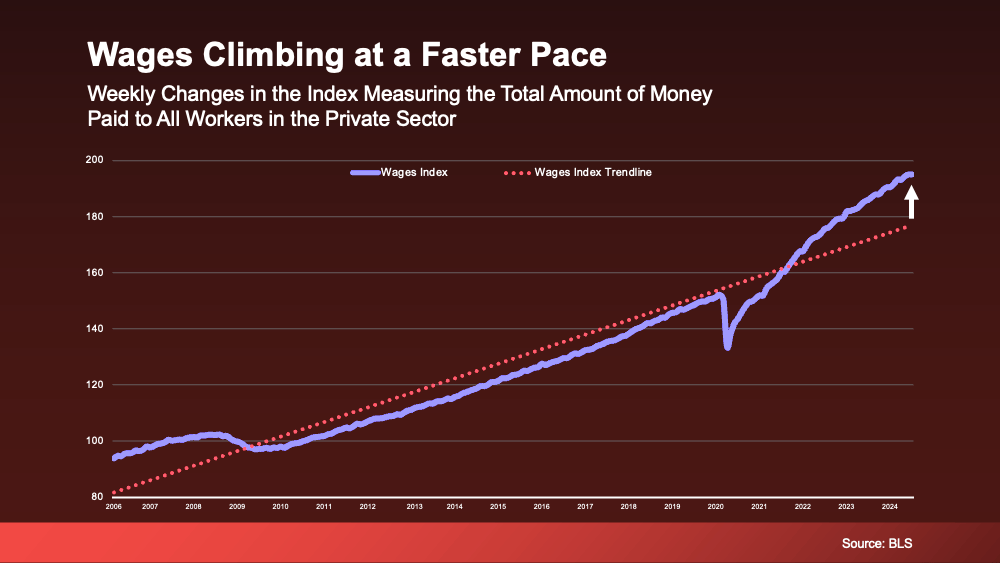

Wages

Rising wages are another factor contributing to improved affordability. The graph below, using data from the Bureau of Labor Statistics (BLS), shows how wages have increased over time:

The blue dotted line represents the typical annual wage growth, while the green line on the right side of the graph shows that wages are currently rising faster than normal. This trend is beneficial for homebuyers because as income increases, it’s easier to afford a home. Higher wages mean you won’t have to allocate as much of your paycheck to your monthly mortgage payment.

The Big Housing Picture

When considering these factors together, the outlook for housing affordability appears hopeful. Mortgage rates are trending down, home prices are rising more slowly, and wages are increasing faster than usual. While affordability remains a challenge, these trends suggest that conditions might be starting to improve.

Call Us Today!

If you’re considering buying a home, now is a promising time to explore your options. Take advantage of the improving trends in mortgage rates, home prices, and wages. For expert guidance and full-service real estate assistance at only 1% commission, saving you thousands of dollars, contact Sell For 1 Percent at 614-451-6616. Our experienced team is here to help you achieve your homeownership dreams with unparalleled service and value.