Big news for homebuyers! Mortgage rates have recently dropped to their lowest point in over a year and a half, making it an exciting time for those looking to buy a home in Columbus, Ohio. If you’ve been waiting on the sidelines for a better opportunity, this could be the moment you’ve been hoping for. Even a small drop in rates can significantly improve your monthly mortgage payment, and the current decline is far from small.

A Significant Drop in Mortgage Rates

According to Sam Khater, Chief Economist at Freddie Mac:

“Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.”

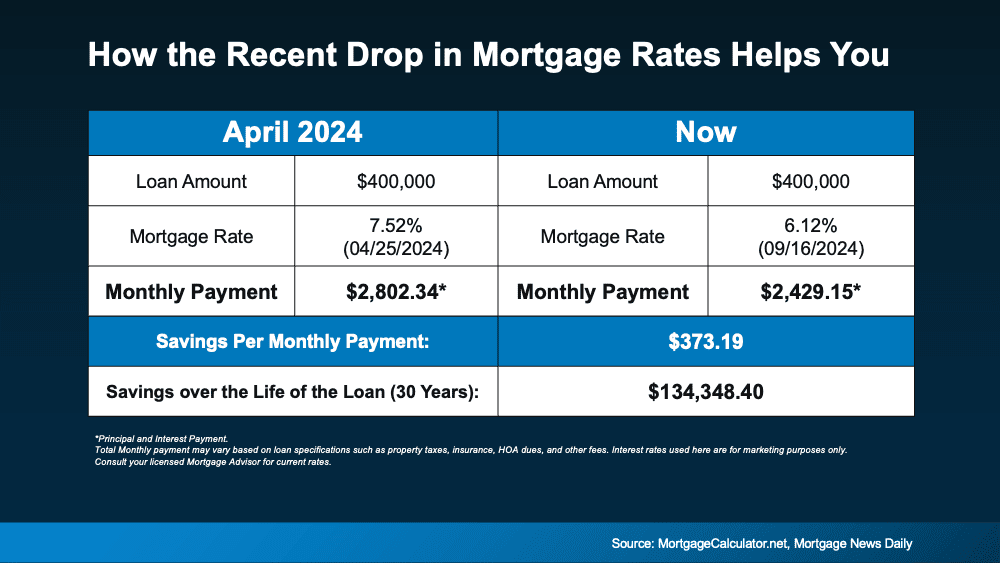

This reduction in rates can translate into substantial savings for homebuyers. For instance, if you were considering purchasing a $400K home just a few months ago, when rates were at 7.5%, your monthly payment would have been significantly higher than it is now with rates dropping into the low 6% range.

How the Math Works Out

Let’s break down the impact of this drop in mortgage rates. The chart below illustrates what the monthly payment (principal and interest) would look like on a $400K loan if you purchased a home back in April when mortgage rates were at their peak versus what it would be if you bought a home now:

As you can see, going from 7.5% to the low 6% range reduces your monthly mortgage payment by over $370. That’s hundreds of dollars in savings each month—money that could go toward savings, home improvements, or other financial goals.

Rates Drop: What That Means for the Columbus Housing Market

The Columbus housing market has been evolving rapidly over the years. As one of the fastest-growing cities in the Midwest, Columbus has seen steady demand for housing, with prices increasing as more people move into the area. Companies like Intel, Amazon, and Facebook have established significant operations in the region, contributing to job growth and making the city an attractive place to live.

Historically, mortgage rate fluctuations have played a key role in shaping the real estate market in Columbus. The recent drop in mortgage rates presents a prime opportunity for buyers to enter the market or upgrade to a new home with more favorable financing options. The lower rates also come at a time when housing inventory in Columbus is improving, offering buyers more choices than they had in previous years.

The Long-Term Impact on Columbus

Over the years, the Columbus housing market has become more competitive, with prices steadily rising. The decline in mortgage rates could further drive demand, particularly for first-time homebuyers who may have been priced out earlier. With home prices in Columbus still relatively affordable compared to major metropolitan areas, the combination of lower rates and a growing job market creates an appealing environment for buyers.

For sellers, this drop in rates could mean more potential buyers entering the market, increasing the chances of securing a deal at or above asking price. Sellers may need to act fast to take advantage of the surge in buyer interest, as rates could fluctuate again.

Why Now is the Time to Buy in Columbus

Increased Purchasing Power

With mortgage rates at their lowest in over 18 months, your purchasing power has increased significantly. This means you can afford more home for your money. Whether you’re looking to buy a starter home, upgrade to a larger property, or invest in real estate, now is an excellent time to explore your options.

More Affordable Monthly Payments

The current rate drop could save you hundreds of dollars each month, as demonstrated earlier. This reduction in monthly payments means you can buy a home that fits your budget more comfortably or take advantage of the savings to invest in home improvements, build equity faster, or boost your savings account.

Columbus: A City on the Rise

Columbus is a city that has been experiencing robust growth, both in population and economic opportunity. As more companies build or expand their presence in the area, the demand for housing continues to rise. Lower mortgage rates will likely spur more activity in the local real estate market, making this the perfect time to buy before prices rise again due to increased competition.

Conclusion: Take Advantage of Rates drop in Columbus

The recent drop in mortgage rates offers a fantastic opportunity for homebuyers in Columbus. With the combination of increased purchasing power, more affordable monthly payments, and a growing housing market, there’s no better time to explore your options.

Ready to make the most of this moment? Call Sell For 1 Percent at 614-451-6616. We’re full-service realtors offering expert guidance with just a 1 percent commission, saving you thousands of dollars. Let’s help you find your dream home in Columbus!