As September rolls in, all eyes, especially Columbus, are on the Federal Reserve (the Fed), with widespread anticipation that they’ll cut the Federal Funds Rate at their upcoming meeting. This expectation is fueled by signs of cooling inflation and a slowing job market. Mark Zandi, Chief Economist at Moody’s Analytics, notes:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market in Columbus, Ohio, and more importantly, for you as a potential homebuyer or seller in this dynamic city?

Why a Federal Funds Rate Cut Matters for Columbus

The Federal Funds Rate is a significant factor that influences mortgage rates, though it’s not the only one. Other factors like the overall economy, geopolitical uncertainties, and local market conditions also play a role.

When the Fed cuts the Federal Funds Rate, it sends a signal about the broader economy, and mortgage rates typically respond. While a single rate cut might not cause mortgage rates to drop dramatically, it could contribute to the gradual decline that’s already underway.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

This upcoming rate cut is likely just the beginning. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), adds:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

How This Affects Columbus Housing Market

Columbus has been on a growth trajectory for years, with significant investments from major companies like Intel, Google, Amazon, and Facebook. These companies are building or moving operations into the area, contributing to job growth and making Columbus a vibrant, appealing place to live. The city’s population growth, coupled with these economic investments, has fueled demand for housing, pushing home prices upward over the past decade.

A cut in the Federal Funds Rate, leading to lower mortgage rates, could further stimulate the Columbus housing market. For many, this could be the opportunity they’ve been waiting for.

The Projected Impact on Mortgage Rates in Columbus

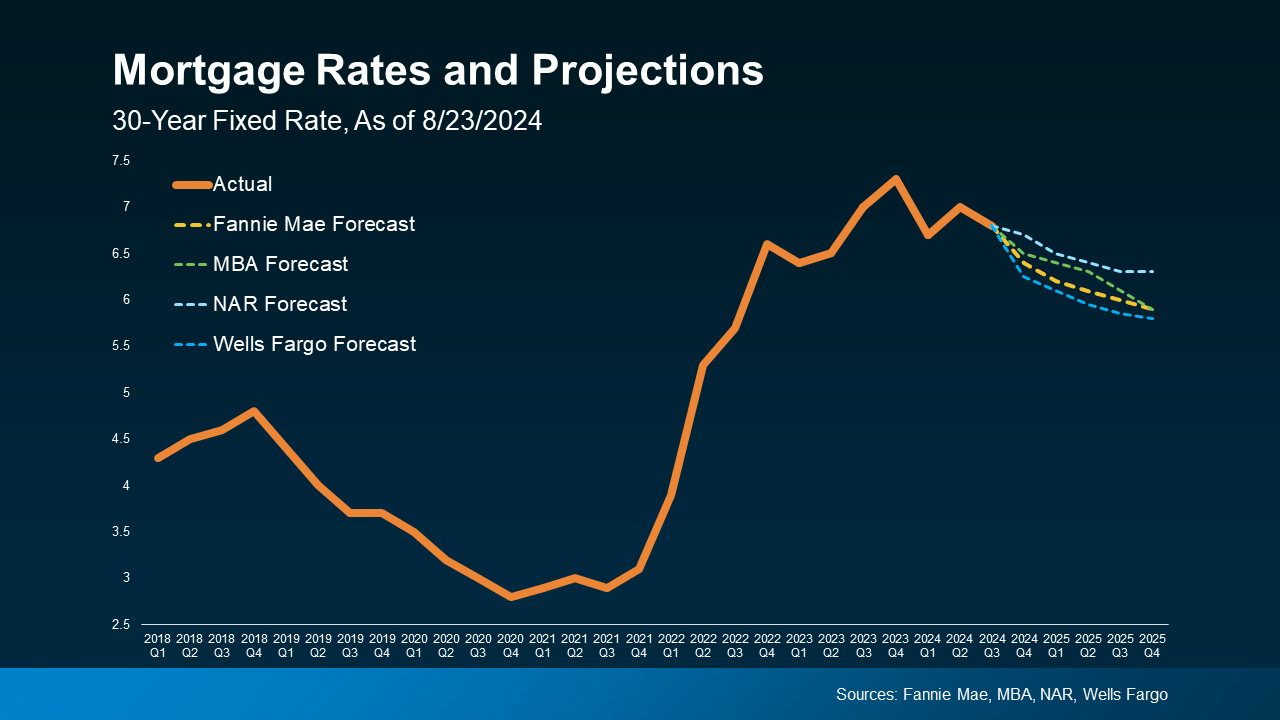

Industry experts project a gradual decline in mortgage rates through 2025, largely driven by anticipated rate cuts from the Fed. The latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo indicate that as inflation cools and the job market slows, mortgage rates could see a moderate decline.

Columbus Housing Market Over the Years

Historically, Columbus has seen steady growth in its housing market. Over the past decade, the city has transformed from a hidden gem in the Midwest to a booming metropolis with a thriving real estate market. Home prices have risen consistently, driven by both local demand and interest from out-of-state buyers.

As more companies establish their presence in Columbus, the demand for housing is expected to continue growing. A reduction in mortgage rates could make homeownership more accessible for a broader range of buyers, potentially boosting sales and maintaining the upward trend in home values.

Benefits of Lower Mortgage Rates for Columbus Buyers and Sellers

1. Easing the Lock-In Effect

For many current homeowners, the prospect of selling their home has been dampened by the “lock-in effect,” where people feel stuck because today’s mortgage rates are higher than those they locked in when they purchased their home. In Columbus, where the market has been competitive, this effect has been particularly pronounced.

A slight reduction in mortgage rates could ease this lock-in effect, making it more attractive for homeowners to sell. However, don’t expect a sudden influx of homes hitting the market—many homeowners may still be cautious about giving up their existing low-rate mortgages.

2. Boosting Buyer Activity

For potential homebuyers in Columbus, any drop in mortgage rates could open up new opportunities. Lower mortgage rates reduce the overall cost of homeownership, making it more feasible for buyers who have been on the fence.

In a city like Columbus, where the housing market has been heating up due to economic growth and an influx of new residents, even a small decrease in mortgage rates could lead to increased buyer activity. This, in turn, could drive home prices higher, especially in desirable neighborhoods.

What Should You Do?

While a Federal Funds Rate cut isn’t expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening. If you’re considering buying or selling in Columbus, now is a great time to evaluate your options.

Jacob Channel, Senior Economist at LendingTree, offers this advice:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Conclusion: The Time to Act is Now

The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, albeit gradual, impact on mortgage rates. This could create new opportunities for both buyers and sellers in the Columbus housing market.

Whether you’re looking to buy your first home or considering selling your current one, now is the time to take action. The Columbus market is thriving, and with the potential for lower mortgage rates, you could find the perfect opportunity to make your move.

Ready to take the next step? Call Sell For 1 Percent at 614-451-6616. We’re full-service realtors offering exceptional service for just 1 percent commission, saving you thousands of dollars. Let’s navigate the Columbus market together!