If you’re in the housing market looking to buy a home, the recent downward trend in mortgage rates brings good news as it contributes to improved affordability. However, there’s another significant benefit that might not be immediately apparent – it could encourage more homeowners to put their houses up for sale.

The Mortgage Rate Lock-In Effect on the Housing Market

Over the past year, one critical factor that has limited options for potential homebuyers is the shortage of available homes. This scarcity has arisen because many homeowners decided to postpone selling their properties when mortgage rates began to rise. An article from Freddie Mac provides insight into this phenomenon:

“The lack of housing supply was partly driven by the rate lock-in effect. . . . With higher rates, the incentive for existing homeowners to list their property and move to a new house has greatly diminished, leaving them rate locked.”

In simpler terms, these homeowners chose to stay in their current homes and maintain their lower mortgage rates rather than relocating and accepting a higher rate on their next home.

Early Signs of Housing Market Change

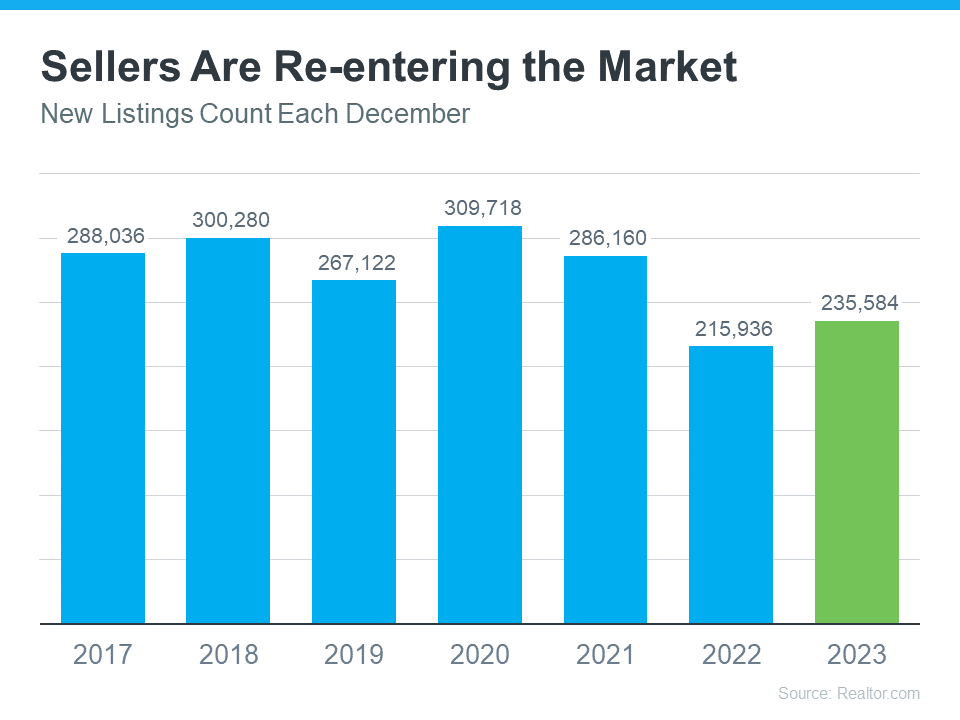

Recent data from Realtor.com reveals a noteworthy shift. In December 2023, there were more homeowners listing their properties for sale, which is commonly referred to as “new listings,” compared to December 2022. This is a significant development because traditionally, the housing market tends to cool down in the later months of the year, as some sellers delay their moves until the new year.

This uptick in new listings during December 2023 is the first of its kind since 2020. It could be an early signal that the rate lock-in effect is easing in response to lower mortgage rates.

Implications for Homebuyers

While it’s unlikely that there will be a sudden surge in available homes, the increase in new listings suggests that more sellers may be considering listing their properties. According to a recent article from the Joint Center for Housing Studies (JCHS):

“A reduction in interest rates could alleviate the lock-in effect and help lift homeowner mobility. Indeed, interest rates have recently declined, falling by a full percentage point from October to November 2023 . . . Further decreases would reduce the barrier to moving and give homeowners looking to sell a newfound sense of urgency . . .”

In practical terms, this means you may start to see more homes entering the market, providing you with a broader range of fresh options to consider.

Bottom Line

As mortgage rates continue to decrease, it’s possible that more sellers will re-enter the market. This presents an opportunity for homebuyers to find the home they’ve been searching for. If you want to stay updated on the latest listings in your area, consider connecting with us, we would love to assist you in your home search journey.