Introduction to Recession Concerns in the Housing Market

In recent years, the topic of a looming recession has dominated discussions, stirring fears of a potential repeat of the devastating 2008 financial crisis. However, a closer examination of expert projections and economic indicators suggests that such a dire outcome is unlikely. This article aims to dispel the concerns about an impending housing market crash by delving into the strength of the current economy and historical patterns of housing crashes.

The Current State of the Economy

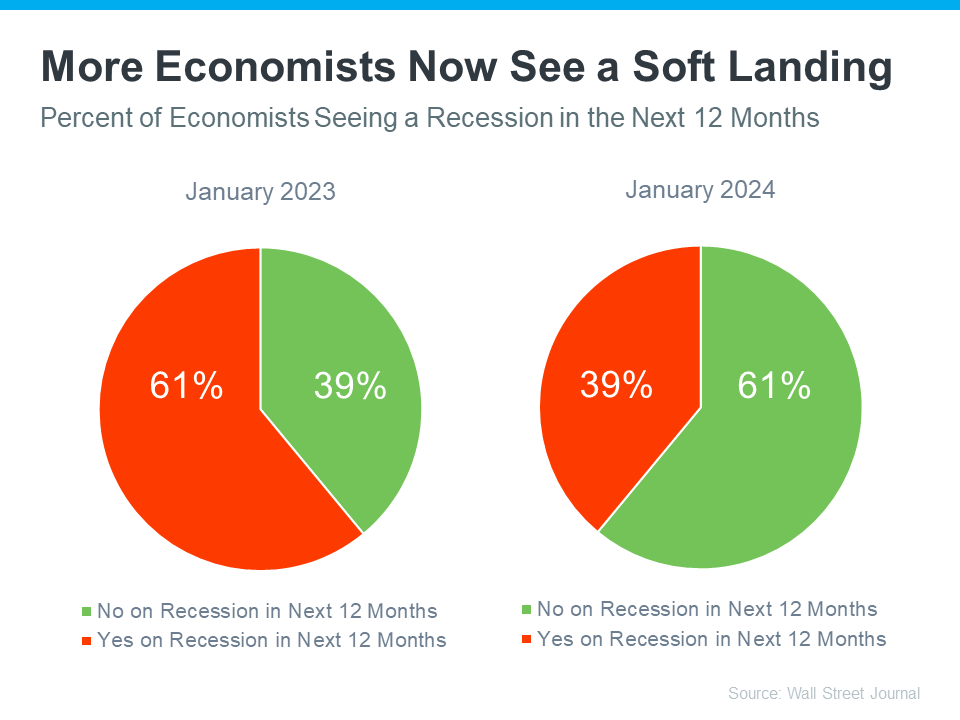

Jacob Channel, Senior Economist at LendingTree, offers a reassuring perspective on the economy’s robustness, stating, “At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect, the economy is probably doing better than people want to give it credit for.” This sentiment is echoed in a recent Wall Street Journal survey, where only 39% of economists anticipate a recession in the next year—a significant decrease from the 61% who predicted a downturn just a year ago.

Unemployment Rate: A Key Indicator for the Housing Market

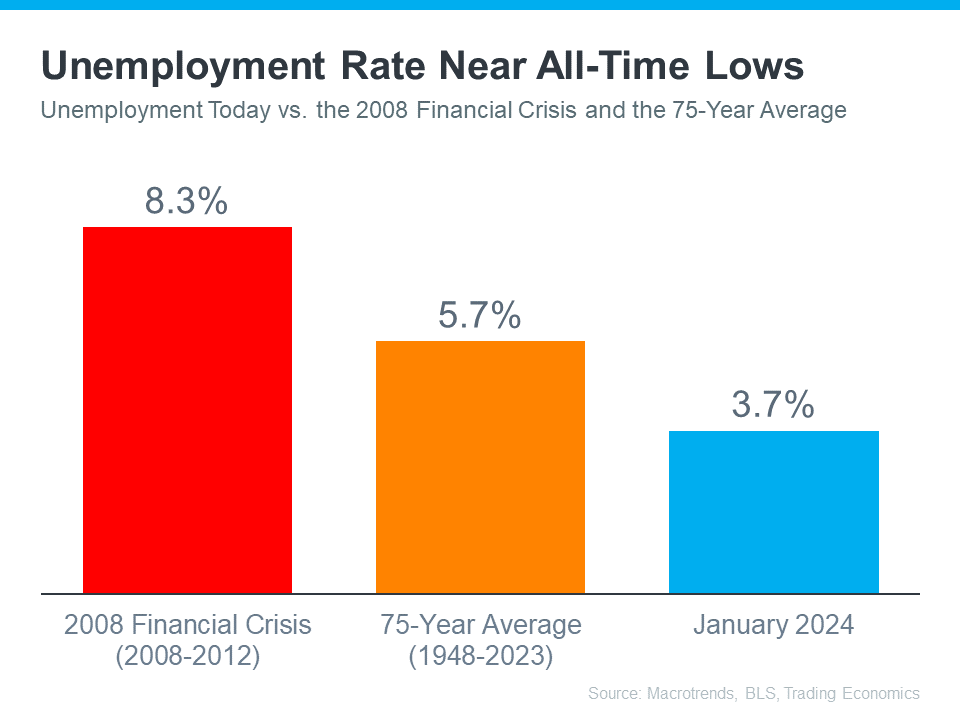

A critical factor in assessing the risk of a housing market crash is the unemployment rate. Historical data from sources like Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics reveal that the current unemployment rate remains notably low. For context, the average unemployment rate since 1948 stands at about 5.7%. This figure spiked to 8.3% following the 2008 financial crisis. Yet, recent data indicates that the unemployment rate is well below these levels, suggesting a stable job market.

Past Housing Market Crashes: Lessons Learned

To further understand the unlikely prospect of a housing market crash, it’s essential to examine past downturns. The 2008 financial crisis, characterized by a significant rise in unemployment and a flood of foreclosures, serves as a cautionary tale. However, several key differences exist between the pre-2008 economy and today’s conditions, including stricter lending standards, a lower supply of housing, and a generally more resilient economic structure.

Future Projections: Unemployment and Housing Market Stability

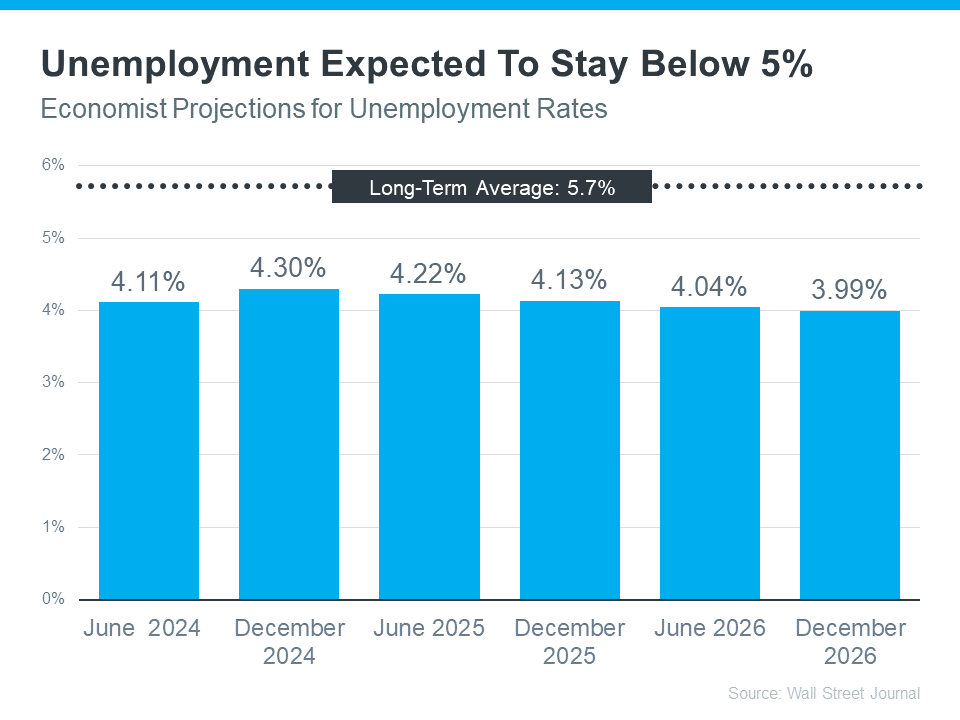

Experts, drawing on data from the aforementioned Wall Street Journal survey, project that the unemployment rate will remain below the 75-year average in the coming years. This stability suggests a lower risk of widespread job losses that could lead to a surge in foreclosures. Consequently, the likelihood of a housing market crash driven by economic factors similar to those of past crises appears minimal.

Conclusion: A Stable Outlook

In summary, most experts now believe that a recession within the next year is improbable, nor do they foresee a significant increase in the unemployment rate. This optimistic outlook, supported by historical analyses and current economic indicators, implies that fears of a flood of foreclosures crashing the housing market are largely unfounded. The key takeaway is that, despite existing challenges, the fundamentals of the economy and the housing market are stronger than commonly perceived, offering reassurance to homeowners and investors alike.